Approximately 304 million individuals got health insurance coverage at some point during 2022. And that number is increasing day by day.

With the demand for comprehensive health insurance, the need for information about the providers offered services increases. So, in this post, we’ll talk about the top 10 health insurance companies in USA, highlighting the leaders in the market.

They are the pioneer in providing millions of Americans with the right healthcare services whenever they need them.

Whether you’re seeking new insurance or evaluating your current coverage, understanding these top contenders is essential. It helps you make an informed decision in today’s complex healthcare environment.

What’s on this page:

Quick List of Top 10 Health Insurance Companies in USA

We are going to talk about all the largest health insurance companies in USA in detail. But first, here’s a quick list of health insurance companies in USA.

- Kaiser Permanente: Offers integrated healthcare and insurance for a seamless member experience.

- UnitedHealthcare: One of the largest U.S. insurers with diverse plan options.

- Elevance Health: Known for its wide network and innovative health solutions.

- HCSC (Blue Cross Blue Shield): Major member-owned health insurer offering extensive care and coverage options.

- Cigna: Global health service leader providing innovative medical, dental, and disability insurance.

- Humana: Offers a wide range of health, wellness, and insurance products.

- Aetna: Delivers comprehensive health insurance services and solutions across the U.S.

- Centene Corporation: Specializes in government-sponsored healthcare programs for the under-insured and uninsured.

- CVS Health: Integrates healthcare services with retail for accessible and affordable care.

- Molina Healthcare: Focuses on high-quality healthcare for individuals through government-sponsored programs.

If you’re looking for the easiest way to find the contact info of the top health insurance companies then you can try Heartbeat Ai. Our tool will help you get the most accurate contact details.

3 Top Health Insurance Companies in USA: Comparison Chart

Dive into our comparison chart of the 3 best health insurance companies in the USA, highlighting key differences to help you make an informed choice.

| Feature | Kaiser Permanente | UnitedHealthcare | Elevance Health |

| Special Features | Emphasis on preventive care and wellness | Large network of providers; diverse plan options | Integrated physical and mental health services |

| Innovation and Technology | Pioneers in healthcare technology & online services | Advanced digital health tools & telehealth services | Focus on innovative health solutions & digital tools |

| Customer Focus | Known for high-quality care & member satisfaction | Comprehensive coverage options & wellness programs | Committed to improving health outcomes & member experience |

Top 3 Health Insurance Companies in USA

By now, you’ve got some basic information to compare the top 3 insurance companies in the health sector. Now we are going talk about a lot more in detail here:

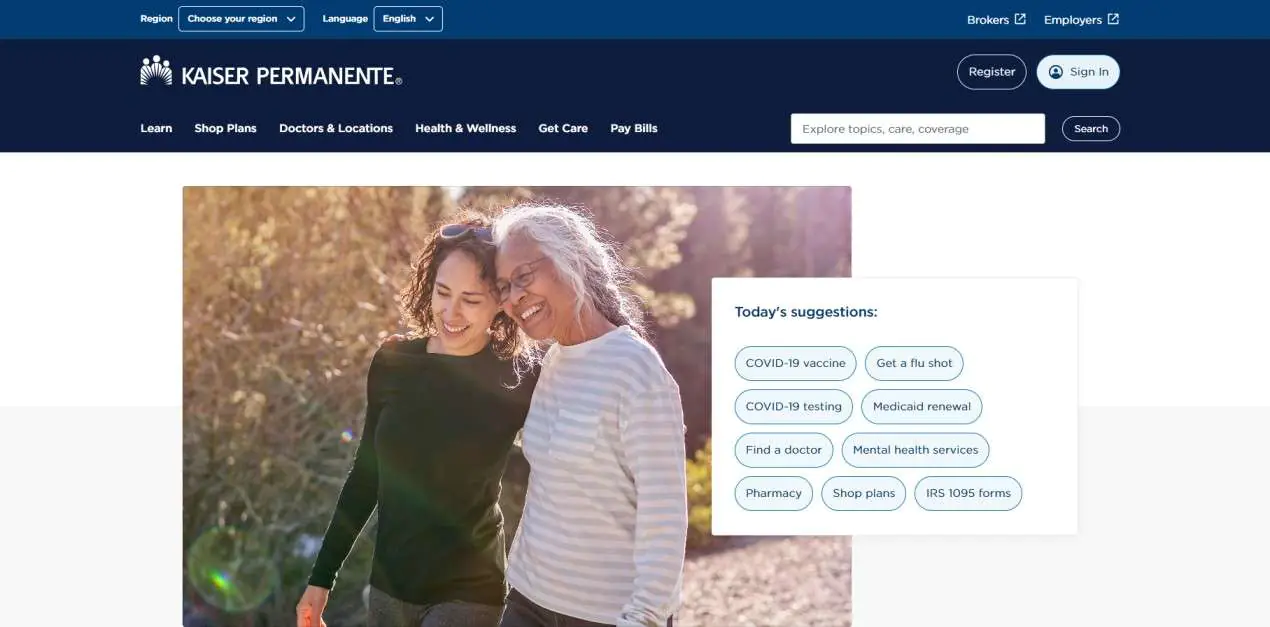

1. Kaiser Permanente

Kaiser Permanente stands as a leader in the health insurance and care provider industry. They are renowned for their integrated model that combines insurance coverage with healthcare services. Founded in 1945, it has grown into one of the nation’s largest not-for-profit health plans.

They operate across several states, offering members access to a comprehensive network of hospitals, physicians, and health services. This unique approach ensures streamlined care, where preventive measures and patient wellness are prioritized.

The organization is committed to delivering high-quality, affordable healthcare, emphasizing the importance of a healthy lifestyle and preventive care. They have been continually working to improve health outcomes for its members.

Overview of Kaiser Permanente

- Founding Year: 1945

- Address: Oakland, California, USA

- Company Size: 216,776 employees

- Contact: 1-800-464-4000

Features of Kaiser Permanente

Here are five key features that define Kaiser Permanente’s success in the healthcare industry.

Integrated Healthcare System

Kaiser Permanente combines healthcare services with insurance coverage, creating a seamless experience for members. This integration ensures coordinated care, as healthcare providers and insurers work together under one umbrella. Patients benefit from a streamlined process, from diagnosis to treatment.

Preventive Care Focus

Emphasizing preventive care, Kaiser Permanente invests in keeping patients healthy before illness strikes. Regular screenings and health education are core to their approach, aiming to reduce the need for more serious medical interventions later on.

Vast Network of Facilities

With an extensive network of hospitals and medical offices, Kaiser Permanente offers convenient access to care across its service areas. Members can easily find facilities close to home, ensuring they receive timely and efficient healthcare services.

Digital Health Solutions

Kaiser Permanente leads in adopting digital health technologies, including online appointment scheduling, electronic health records, and telehealth services. These tools enhance patient engagement and access to care, making health management easier for members.

Research and Innovation

The organization is committed to medical research and innovation, continuously seeking new ways to improve health outcomes. Through its research centers, Kaiser Permanente contributes to advancements in medicine and healthcare, benefiting not only its members but the wider community.

Pros

- Integrated healthcare and insurance model.

- Strong emphasis on preventive care.

- Extensive network of hospitals and clinics.

- Advanced digital health services.

- Commitment to research and innovation.

Cons

- Available only in certain states.

- Some reports of long wait times for appointments.

- Limited to using Kaiser Permanente facilities and doctors.

Our Review of Kaiser Permanente

Kaiser Permanente truly excels in providing a unified healthcare experience. Their healthcare management is straightforward and stress-free. Their focus on preventive health and wellness is not only innovative but genuinely impactful.

The ease of accessing healthcare services is a significant advantage. It simplifies the healthcare journey for users. Kaiser Permanente’s commitment to quality and affordability shines through. That makes it a top choice for those seeking comprehensive health coverage and care.

2. UnitedHealthcare

UnitedHealthcare, a division of UnitedHealth Group, is one of the largest health insurance providers in the United States, serving millions of members nationwide. Since its founding, UnitedHealthcare has been committed to improving the healthcare system and helping people live healthier lives.

The company offers a wide range of health insurance products and services, including medical, dental, vision, and prescription drug plans for individuals, employers, and Medicare and Medicaid beneficiaries.

With a vast network of healthcare professionals and facilities, UnitedHealthcare emphasizes personalized care, preventive services, and access to quality healthcare.

Overview of UnitedHealthcare

- Founding Year: 1977

- Address: Minnetonka, Minnesota, USA

- Company Size: 400,000 employees worldwide

- Contact: 1-800-657-8205

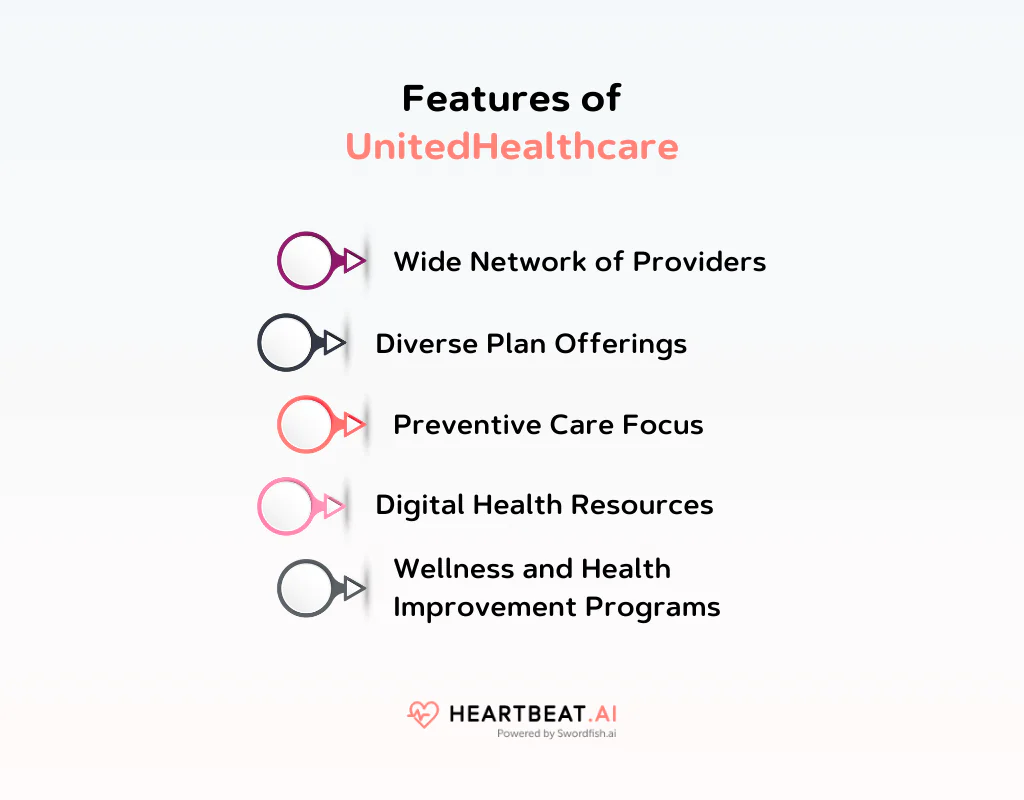

Features of UnitedHealthcare

UnitedHealthcare stands as a giant in the health insurance industry. Here’s a closer look at some of the defining features of UnitedHealthcare.

Wide Network of Providers

UnitedHealthcare boasts one of the largest networks in the country, providing members with access to a vast selection of doctors, specialists, and hospitals. This extensive network ensures that members can find the right care near them, reducing wait times and travel distances for medical appointments.

Diverse Plan Offerings

The company offers a wide variety of health insurance plans, including options for individuals, families, employers, and Medicare and Medicaid beneficiaries. This diversity allows members to select plans that best fit their health needs and financial situations, making personalized care accessible to a wider audience.

Preventive Care Focus

Emphasizing the importance of preventive care, UnitedHealthcare covers a range of preventive services at no extra cost. This approach aims to catch health issues early and promote overall wellness, ultimately leading to better health outcomes and reduced healthcare costs.

Digital Health Resources

UnitedHealthcare integrates technology into its services, offering digital tools like mobile apps for health management, virtual doctor visits, and online wellness programs. These resources make it easier for members to manage their health, access care, and receive support, enhancing convenience and engagement.

Wellness and Health Improvement Programs

The insurer provides members with programs and incentives designed to encourage healthier lifestyles. These include fitness program discounts, smoking cessation support, and weight loss programs. By investing in the well-being of its members, UnitedHealthcare supports not just treatment but overall health improvement.

Pros

- Extensive network of healthcare providers.

- Comprehensive range of insurance products and services.

- Strong emphasis on preventive care and wellness.

- Advanced digital health tools for members.

- Wide coverage, including Medicare and Medicaid plans.

Cons

- Some customers report challenges with customer service.

- Complexity of plan options can be confusing for some.

- Coverage limitations and denials for certain treatments.

Our Review of UnitedHealthcare

UnitedHealthcare highlights its strength in providing comprehensive health coverage and access to an extensive network of healthcare providers.

The company’s focus on preventive care and wellness initiatives, along with its user-friendly digital tools, significantly enhances the healthcare journey.

UnitedHealthcare’s commitment to customer service and personalized care has made managing health benefits smoother and more accessible.

3. Elevance Health

Elevance Health, formerly known as Anthem, Inc., is a leading health benefits company dedicated to improving lives and communities while simplifying healthcare. Since its establishment, Elevance Health has grown to become one of the largest health insurers in the United States.

With its headquarters in Indianapolis, Indiana, Elevance Health serves over 40 million members across its affiliated health plans. The company offers a broad range of health insurance products. That includes medical, pharmacy, dental, and vision coverage, as well as life and disability insurance.

Elevance Health operates under a mission to transform health care with trusted and caring solutions. They focus on whole-person health by integrating physical and mental health services to address complex conditions comprehensively.

Overview of Elevance Health

- Founding Year: 2004

- Address: Indianapolis, Indiana, USA

- Company Size: 102,213 employees

- Contact: (833) 401-1577

Features of Elevance Health

Here are five notable features that distinguish Elevance Health in the healthcare industry.

Integrated Health Services

Elevance Health emphasizes the integration of physical and mental health services, offering a coordinated approach to healthcare. This holistic strategy ensures members receive comprehensive care, addressing all aspects of their health and well-being. By treating the individual as a whole, Elevance Health aims to improve overall health outcomes and member satisfaction.

Expansive Provider Network

Members have access to an extensive network of healthcare providers, including specialists, hospitals, and clinics. This broad network facilitates easy access to high-quality care reducing wait times. That makes it more convenient for members to receive the treatment they need when they need it.

Diverse Insurance Plans

Elevance Health provides a wide array of insurance plans, catering to various needs and budgets. From individual and family plans to Medicare and Medicaid services, the company offers flexible options. That allows members to choose plans that best suit their healthcare needs and financial circumstances.

Community Health Initiatives

Beyond individual care, Elevance Health is actively involved in community health initiatives aimed at improving public health and addressing social determinants of health. These programs focus on preventive care, health education, and supporting underserved communities.

Digital Health Solutions

Leveraging technology, Elevance Health provides innovative digital health solutions, including telehealth services, mobile apps for health management, and online wellness programs. These tools enhance the healthcare experience. They offer members convenient and personalized ways to manage their health, access care, and engage with their healthcare providers.

Pros

- Comprehensive range of health insurance products.

- Large network of healthcare providers.

- Focus on integrated physical and mental health services.

- Strong commitment to improving community health.

- Innovative use of technology to enhance member experience.

Cons

- Complex plan options can be confusing for some members.

- Coverage limitations for certain treatments or services.

Our Review of Elevance Health

Elevance Health has been notably positive, highlighting the company’s commitment to comprehensive and integrated health solutions. Their focus on whole-person health is evident in the seamless coordination between physical and mental health services, ensuring members receive holistic care.

Elevance Health’s extensive network and diverse insurance options have made accessing quality healthcare easier and more personalized. It confirms their role as a leader in the health insurance industry.

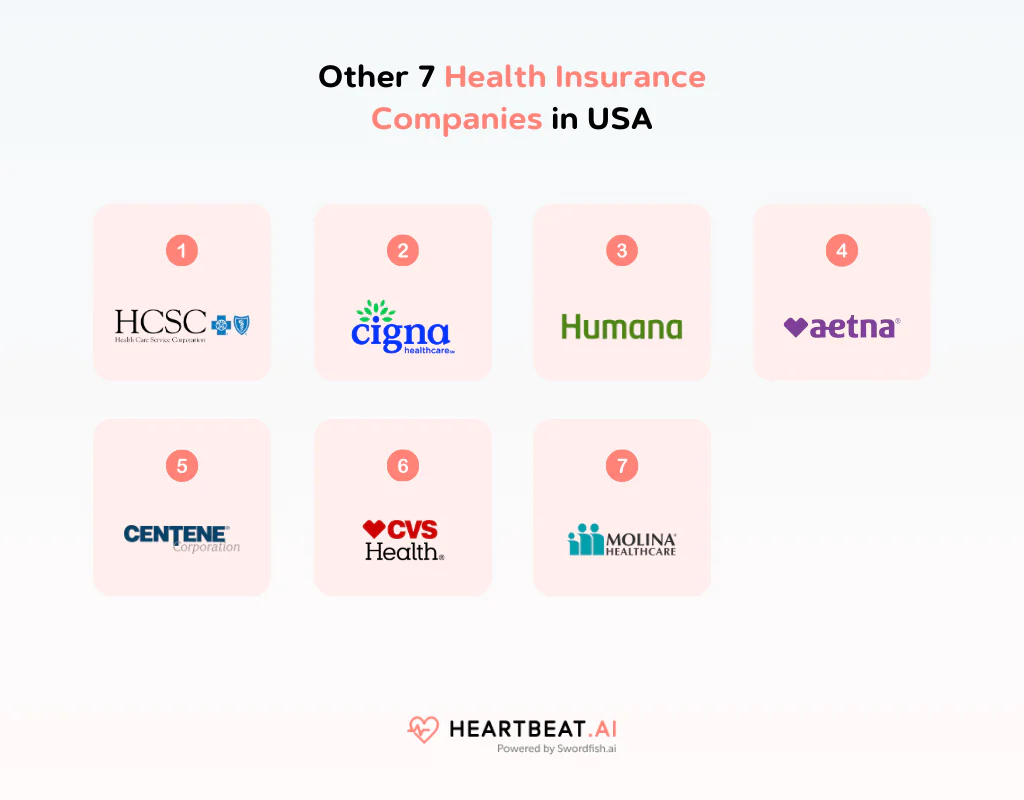

Other 7 Health Insurance Companies in USA

1. HCSC (Blue Cross Blue Shield)

Health Care Service Corporation (HCSC), operating under the Blue Cross Blue Shield (BCBS) brand, is a customer-owned health insurer in the United States. Founded in 1936, HCSC is one of the largest health insurance companies.

Headquartered in Chicago, Illinois, HCSC stands out for its commitment to community health, preventive care, and innovative health solutions. The company operates BCBS plans in Illinois, Montana, New Mexico, Oklahoma, and Texas, offering services that include PPO, HMO, dental insurance, and Medicare plans.

HCSC’s mission is to expand access to affordable, quality health care and to invest in the health and well-being of its communities. That makes it a pillar in the American healthcare system.

Overview of Health Care Service Corporation

- Founding Year: 1936

- Address: 300 East Randolph Street, Chicago, IL 60601, USA

- Company Size: Approximately 24,000 employees

- Contact: 800-531-4456

2. Cigna

Cigna is a global health service company dedicated to improving the health, well-being, and peace of mind of those it serves. It was established in 1792 through its INA (Insurance Company of North America) heritage.

Since then, Cigna has grown into a multinational entity that offers health insurance and related products and services.

Headquartered in Bloomfield, Connecticut, USA, Cigna operates across 30 countries and jurisdictions. The company offers a vast array of health services, including medical, dental, disability, life, and accident insurance.

Cigna stands out for its focus on personalized care, innovative health solutions, and a commitment to making healthcare simple, affordable, and predictable for individuals and businesses alike.

Overview of Cigna

- Founding Year: 1792

- Address: Bloomfield, Connecticut, USA

- Company Size: Approximately 73,800 employees

- Contact: Cigna’s Official Website

3. Humana

Founded in 1961, Humana has evolved from a single nursing home to a national leader in healthcare. They offer services such as health insurance, Medicare plans, and managed care.

Based in Louisville, Kentucky, Humana’s mission is to help people achieve their best health through coordinated care, preventive measures, and access to fitness and wellness programs.

With a strong emphasis on innovation and customer service, Humana serves millions of members across the United States, focusing on creating simplified experiences and improving health outcomes. The company is committed to sustainable health solutions that support lifelong well-being for individuals and families.

Overview of Humana

- Founding Year: 1961

- Address: Louisville, Kentucky, USA

- Company Size: 74,000 employees

- Contact: 1 (800) 997-1654

4 . Aetna

Aetna, a renowned name in the health insurance industry, offers a comprehensive range of health care services. That includes medical, pharmacy, dental, behavioral health, and disability plans.

Now a subsidiary of CVS Health Corporation, Aetna is headquartered in Hartford, Connecticut, and serves millions of members nationwide. The company is dedicated to building a healthier world by simplifying the healthcare experience, improving health outcomes, and reducing system costs.

Aetna’s approach emphasizes personalized care. They use technology and data analytics to support preventive care initiatives for their members. With a focus on customer-centric solutions, Aetna strives to make high-quality health care more accessible and affordable.

Overview of Aetna

- Founding Year: 1853

- Address: Hartford, Connecticut, USA

- Company Size: 47,950 employees

- Contact: 1-800-624-0756

5. Centene Corporation

Centene Corporation is a diversified, multinational healthcare company providing a portfolio of services to government-sponsored healthcare programs, focusing on under-insured and uninsured individuals. Since its founding in 1984, Centene has grown to become a leading provider of managed care, emphasizing affordable and high-quality healthcare services.

Headquartered in St. Louis, Missouri, Centene operates across the United States and internationally. It offers a broad range of health solutions including Medicaid and Medicare plans as well as specialty services.

The company’s commitment to its members is evident in its efforts to innovate responsive healthcare solutions.

Through their comprehensive approach and dedication, they are improving the health of their users. Centene Corporation plays a crucial role in transforming the health of the community, one individual at a time.

Overview of Centene Corporation

- Founding Year: 1984

- Address: St. Louis, Missouri, USA

- Company Size: 82,000 employees

- Contact: 314-725-4477

6. CVS Health

CVS Health is a health innovation company with a mission to improve the health outcomes of its customers and communities. Founded in 1963, CVS Health has evolved from a chain of retail pharmacies to a diversified health services company.

Headquartered in Woonsocket, Rhode Island, CVS Health aims to make healthcare more accessible and affordable while simplifying the experience for consumers. Through its extensive network of locations and digital health solutions, CVS Health is uniquely positioned to serve millions of people across the United States with its integrated offerings.

The company’s focus on innovation, customer care, and community health has established it as a leader in the healthcare industry, dedicated to delivering cutting-edge services and improving the quality of life for individuals nationwide.

Overview of CVS Health

- Founding Year: 1963

- Address: Woonsocket, Rhode Island, USA

- Company Size: 300,000 employees

- Contact: 1-800-746-7287

7. Molina Healthcare

Molina Healthcare is a prominent health insurance company that specializes in providing quality healthcare services to individuals and families who qualify for government-sponsored programs.

Headquartered in Long Beach, California, the company’s mission is to improve the health and lives of its members by prioritizing customer service, community health, and comprehensive healthcare solutions.

Molina Healthcare’s approach combines personalized care management, innovative health programs, and extensive provider networks to ensure members receive the care they need.

Overview of Molina Healthcare

- Founding Year: 1980

- Address: Long Beach, California, USA

- Company Size: 15,000 employees

- Contact: (888) 665-4621

What to Consider When Choosing the Best Health Insurance Companies?

It involves considering various factors to find a provider that meets your health needs and financial situation.

Here’s what to keep in mind:

Coverage Scope

Consider the extent of coverage offered. The best health insurance companies provide a comprehensive range of services, including preventive care, hospitalization, emergency services, and prescription drugs.

Ensure the plan covers your specific health needs, such as maternity care, mental health services, or chronic disease management.

Network of Providers

You need to consider the insurance company’s network of healthcare providers. A larger network means more choices for doctors, specialists, and healthcare facilities reducing out-of-pocket costs for services outside the network. Ensure your preferred doctors and hospitals are covered.

Costs

Understand all costs involved, not just the premium. This includes deductibles, copayments, coinsurance, and out-of-pocket maximums.

A lower premium might mean higher out-of-pocket costs when you need care, so balance the premium against other costs.

Customer Service

Quality customer service can significantly impact your healthcare experience. Look for companies with positive reviews for customer support, ease of filing claims, and managing policies. Good customer service means less stress when you need care.

Plan Flexibility

Consider how flexible the plan is. Some insurance companies offer customizable plans or a variety of plan options to better match your specific needs.

Flexibility can also refer to the ease of changing plans, adding or removing coverage, or switching healthcare providers within the network.

Reputation and Financial Stability

Research the company’s reputation and financial stability. Established companies with a strong track record are more likely to provide reliable coverage and handle claims efficiently.

Look for ratings from independent agencies and read customer reviews to gauge satisfaction.

Find the Contact List of the Best Health Insurance Companies

Choosing the right health insurance companies can be daunting. But here Heartbeat AI can come in to help. Here’s how Heartbeat AI helps you in that process:

Extensive Database Access

Heartbeat AI provides access to an expansive database featuring information on over 11 million USA healthcare professionals, including key contacts within health insurance companies. This resource is invaluable for identifying providers that match specific criteria, ensuring a comprehensive search.

Advanced Contact Information

With Heartbeat Prospector, you will get access to 8.8 million direct cell phone numbers and 9.3 million personal email addresses. We have an 84% accuracy rate for cell numbers and 92% for emails on the first attempt.

This direct access facilitates easier and more effective communication with potential insurance partners.

Enhanced Networking Capabilities

Utilize Heartbeat AI’s Chrome extension to enhance your networking reach across LinkedIn, Facebook, and the web. This feature allows for broader exploration and connection opportunities with health insurance companies, enriching your options.

Updated and Reliable Data

Heartbeat AI ensures that all information, including contact details and company data, is regularly updated. This commitment to accuracy provides confidence in making informed decisions based on the latest and most reliable information available.

User-Friendly Interface

The platform’s design prioritizes ease of use, making it accessible to individuals at all levels of tech-savviness. Searching for the best health insurance companies becomes a straightforward and hassle-free process. It allows you to focus on what truly matters: finding the right coverage.

Conclusion

To sum it up, these companies have become the leaders in this industry for their extensive range of services and commitment to improving patient care. They offer vast networks of healthcare providers to integrate innovative health solutions.

The focus on preventive care, customer service, and flexible plan options make them preferred choices for millions of Americans. As the healthcare industry continues to evolve, these top 10 health insurance companies in USA are expected to lead the way.

They offer accessible, affordable, and patient-centered health insurance solutions. Choosing among these leaders allows you to be assured in your health journey with confidence.

Frequently Asked Questions

Are these health insurance companies available nationwide?

Yes, most common health insurance companies offer coverage nationwide, but the availability of specific plans and networks may vary by location.

How can I determine which health insurance plan is right for me?

To find the right plan, assess your healthcare needs, including doctor preferences, prescription medications, and expected medical expenses. Compare different plans based on these factors to make an informed decision.

Do these companies offer specialized plans for specific healthcare needs?

Yes, many of these insurers provide specialized plans, such as Medicare Advantage, Medicaid, or plans customized for individuals with chronic conditions. It’s important to explore these options if they match your healthcare requirements.